AA Exam Dumps - Audit & Insurance

Reliable Study Materials & Testing Engine for AA Exam Success!

Exam Code: AA

Exam Name: Audit & Insurance

Certification Provider: CPA

Certification Exam Name: certified public accountant

Verified By IT Certified Experts

DumpsArena.com Certified Safe Files

Guaranteed To Have Actual Exam Questions

Up-To-Date Exam Study Material

99.5% High Success Pass Rate

100% Accurate Answers

100% Money Back Guarantee

Instant Downloads

Free Fast Exam Updates

Exam Questions And Answers PDF

Best Value Available in Market

Try Demo Before You Buy

Secure Shopping Experience

AA: Audit & Insurance Study Material and Test Engine

Last Update Check: Mar 25, 2025

Latest 80 Questions & Answers

45-75% OFF

Hurry up! offer ends in 00 Days 00h 00m 00s

*Download the Test Player for FREE

What is in the Premium File?

CPA AA Exam FAQs

Introduction of CPA AA Exam!

The CPA Exam is a comprehensive exam administered by the American Institute of Certified Public Accountants (AICPA). It is designed to assess the knowledge and skills of individuals who wish to become certified public accountants (CPAs). The exam consists of four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Each section is four hours long and consists of multiple-choice questions and task-based simulations.

What is the Duration of CPA AA Exam?

The Certified Public Accountant (CPA) Exam is a four-part exam that takes approximately 14 hours to complete. Each part of the exam is four hours long and consists of multiple-choice questions and task-based simulations.

What are the Number of Questions Asked in CPA AA Exam?

The CPA Auditing and Attestation (AUD) exam consists of 72 multiple-choice questions and 8 task-based simulations.

What is the Passing Score for CPA AA Exam?

The passing score required to pass the CPA AA Exam is 75.

What is the Competency Level required for CPA AA Exam?

The CPA AA Exam is a two-part exam that tests the knowledge and skills of accounting professionals. The first part of the exam is the Uniform CPA Examination, which tests the knowledge and skills of accounting professionals in the areas of auditing, financial accounting and reporting, regulation, and business environment and concepts. The second part of the exam is the Advanced Accounting Exam, which tests the knowledge and skills of accounting professionals in the areas of advanced accounting, taxation, and business law. To pass the CPA AA Exam, candidates must demonstrate a mastery of the material covered in the exam and demonstrate a competency level of at least 80%.

What is the Question Format of CPA AA Exam?

The CPA Advanced Auditing (AA) Exam consists of multiple-choice questions, task-based simulations, and written communication tasks. The multiple-choice questions test candidates on their knowledge of auditing standards and procedures, including identification of risk, developing and documenting audit steps, and evaluating audit results. The task-based simulations require candidates to apply their knowledge of auditing principles to a business scenario. The written communication tasks require candidates to interpret the results of their audit procedures and explain their recommendations to the client.

How Can You Take CPA AA Exam?

The CPA AA exam is offered both online and at testing centers. To take the exam online, applicants must first register through the National Association of State Boards of Accountancy (NASBA) website. Once registered, applicants will receive a link to the approved testing center, where they can take the exam. To take the exam at a testing center, applicants must first register through the Prometric website. Once registered, applicants will be given a list of approved testing centers and a unique Prometric ID. They can then select an available testing center and register for an exam date.

What Language CPA AA Exam is Offered?

The Certified Public Accountant (CPA) Auditing and Attestation (AA) Exam is offered in English.

What is the Cost of CPA AA Exam?

The cost of the CPA AA Exam varies by state. Generally, the cost is between $150 and $200 for the exam, plus any additional fees for registration or other services.

What is the Target Audience of CPA AA Exam?

The target audience for the CPA AA Exam is individuals who are actively working in the accounting profession and have either completed or are in the process of completing the requisite 150 credit hours of college education with a concentration in accounting, taxation, and/or auditing.

What is the Average Salary of CPA AA Certified in the Market?

The average salary for a CPA with an AA certification varies depending on the industry and geographic area, but the average salary is usually between $50,000 and $90,000.

Who are the Testing Providers of CPA AA Exam?

The American Institute of Certified Public Accountants (AICPA) administers the CPA Exam. You can register for the Exam through your state board of accountancy.

What is the Recommended Experience for CPA AA Exam?

The recommended experience for CPA AA exam is to have at least two years of public accounting experience, including auditing and attestation services, or have a minimum of one year of governmental or non-profit auditing experience. This experience should be verified by an approved supervisor. Additionally, applicants should have a bachelor’s degree in accounting or a related field, as well as 150 semester hours of college credit, including a minimum of 24 semester hours in accounting and 24 semester hours in auditing.

What are the Prerequisites of CPA AA Exam?

The Prerequisite for CPA AA Exam is a bachelor's degree in accounting. You must also have at least two years of professional experience in the field of accounting, auditing, or taxation. Additionally, you will need to meet the state's education and/or experience requirements for CPA licensure.

What is the Expected Retirement Date of CPA AA Exam?

The official website for the American Institute of Certified Public Accountants (AICPA) provides information about the CPA Exam and its retirement dates. You can find this information at https://www.aicpa.org/becomeacpa/cpaexam/exam-retirement-dates.html.

What is the Difficulty Level of CPA AA Exam?

The CPA AA exam is considered to be a challenging exam. It is designed to measure a candidate's knowledge and understanding of the key topics in accounting and auditing. The exam covers a wide range of topics and requires a high level of proficiency in the subject matter. The difficulty level of the exam is considered to be high.

What is the Roadmap / Track of CPA AA Exam?

Certification Track/Roadmap CPA AA Exam is a program offered by the American Institute of Certified Public Accountants (AICPA) to help aspiring accountants prepare for the Uniform CPA Examination. The program is designed to help candidates identify the topics and skills they need to know in order to pass the exam. The program includes a series of study guides, practice tests, and a personalized study plan to help candidates prepare for the exam.

What are the Topics CPA AA Exam Covers?

The CPA Auditing and Attestation (AUD) exam covers a variety of topics related to auditing and assurance services. The topics covered in the exam include:

1. Engagement Planning: This section covers topics related to planning an audit engagement, including risk assessment, audit strategies, and audit evidence.

2. Internal Control: This section covers topics related to internal control, including control environment, control activities, and information and communication.

3. Understanding the Entity and Its Environment: This section covers topics related to understanding the entity and its environment, including entity structure, legal and regulatory requirements, and economic factors.

4. Assessing Risk and Developing a Planned Response: This section covers topics related to assessing risk and developing a planned response, including risk assessment procedures, audit objectives, and audit evidence.

5. Performing Audit Procedures and Obtaining Evidence: This section covers topics related to performing audit procedures and obtaining evidence, including audit procedures,

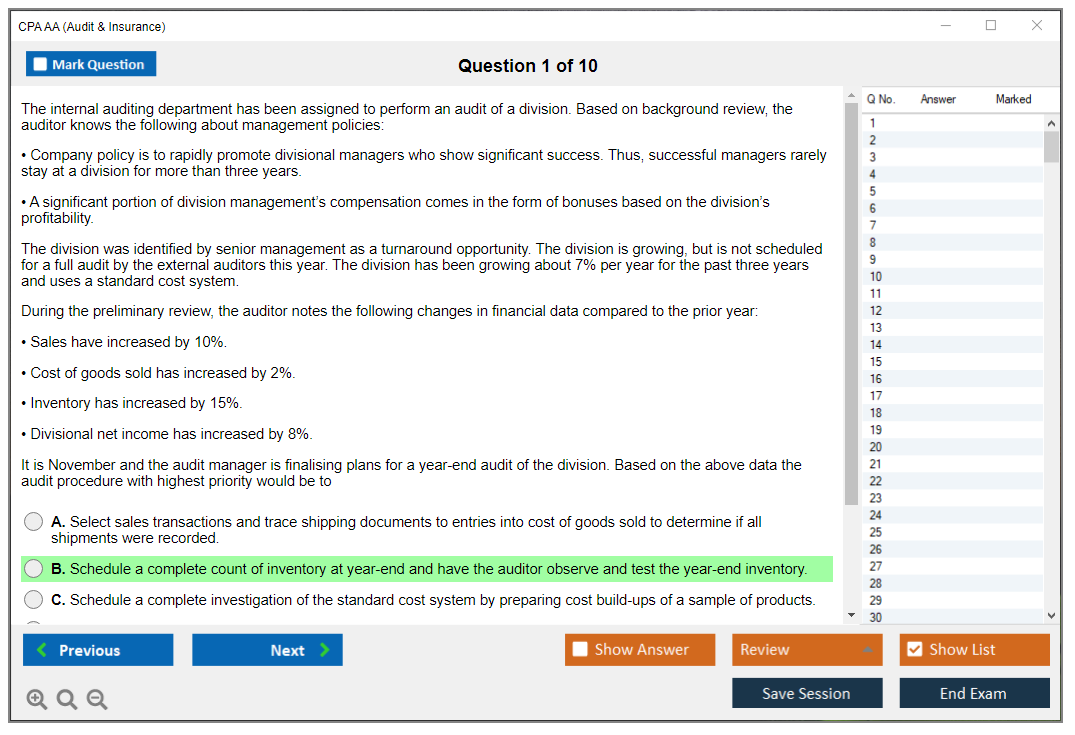

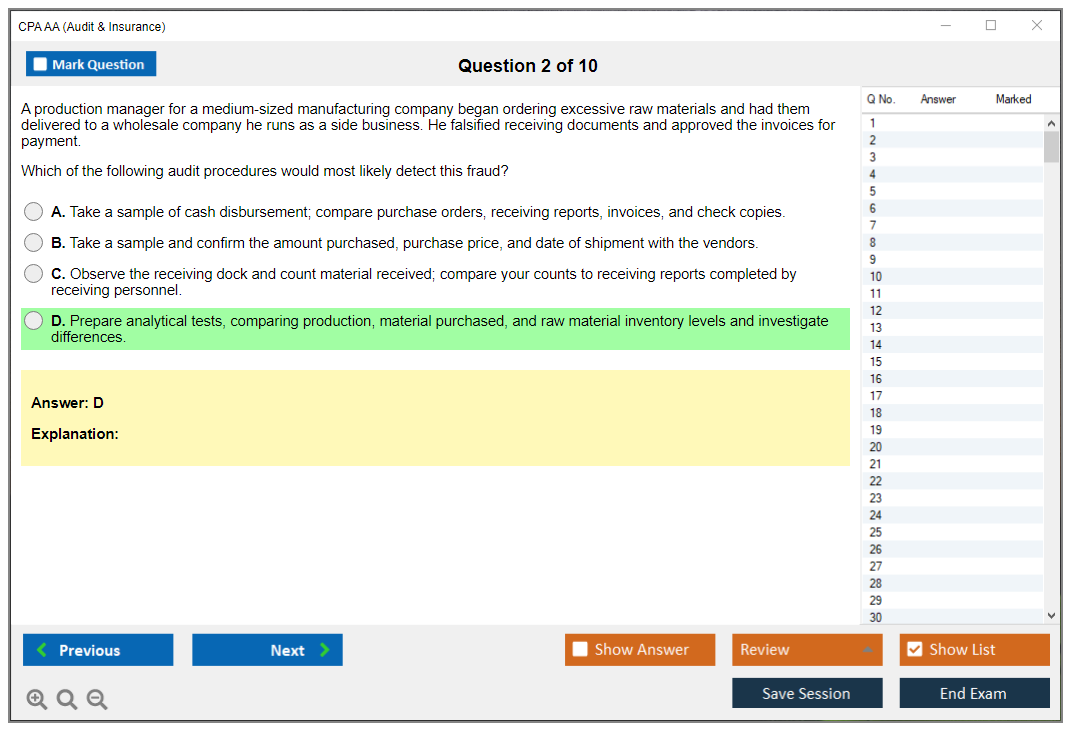

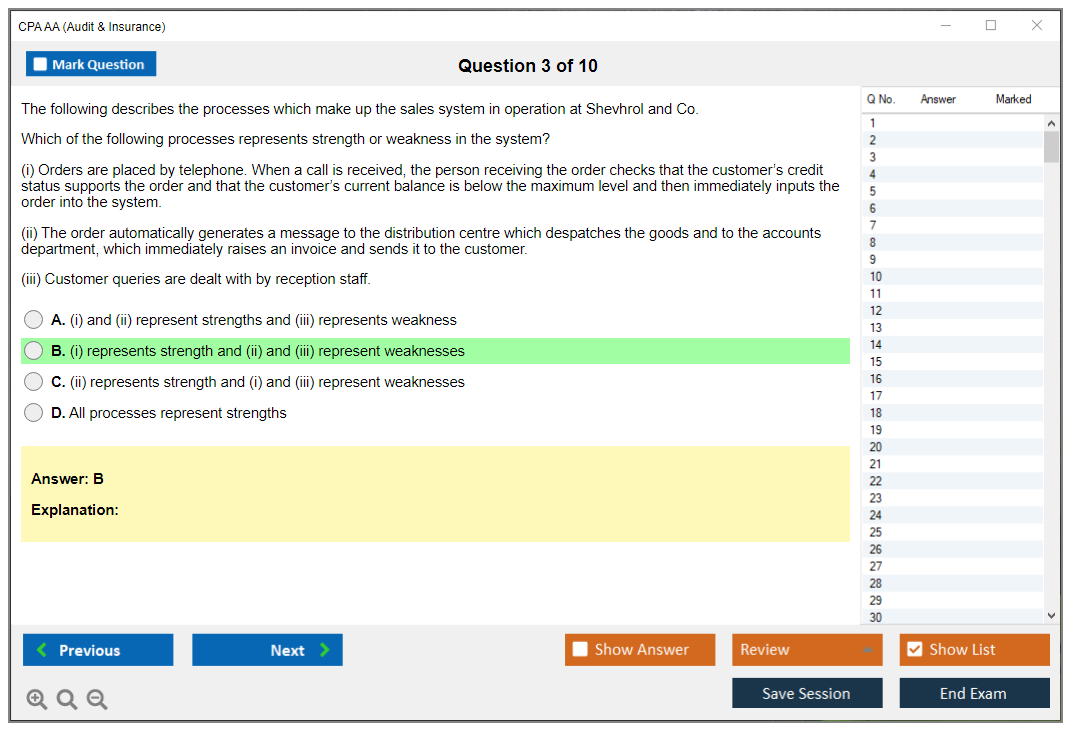

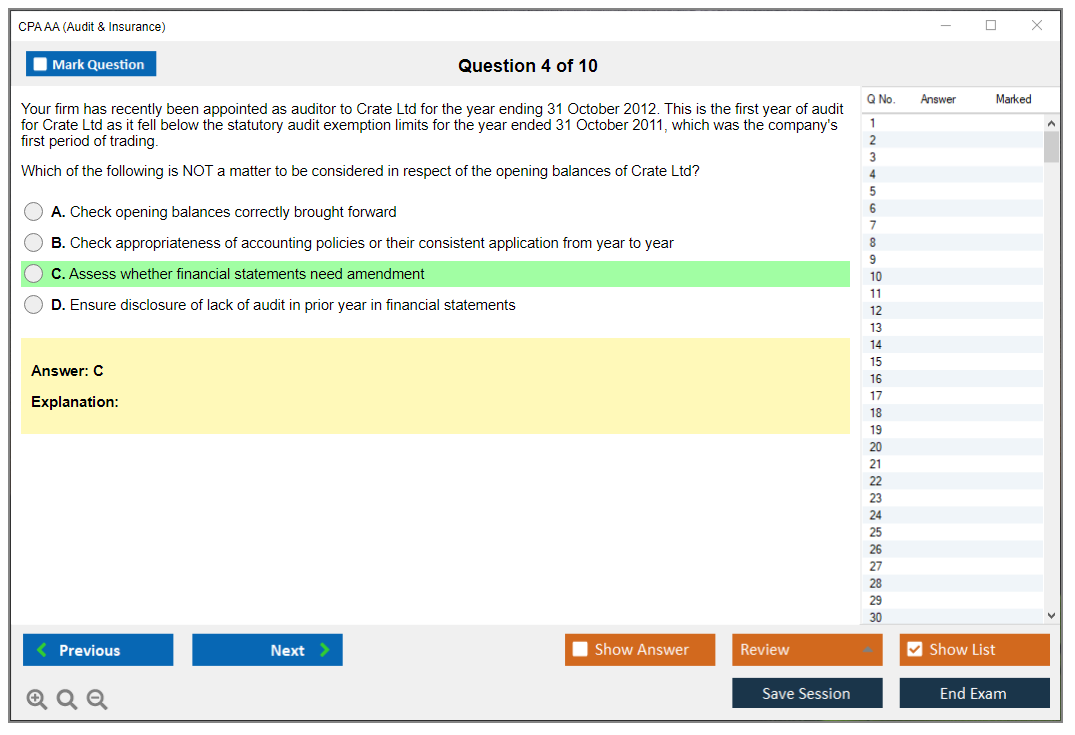

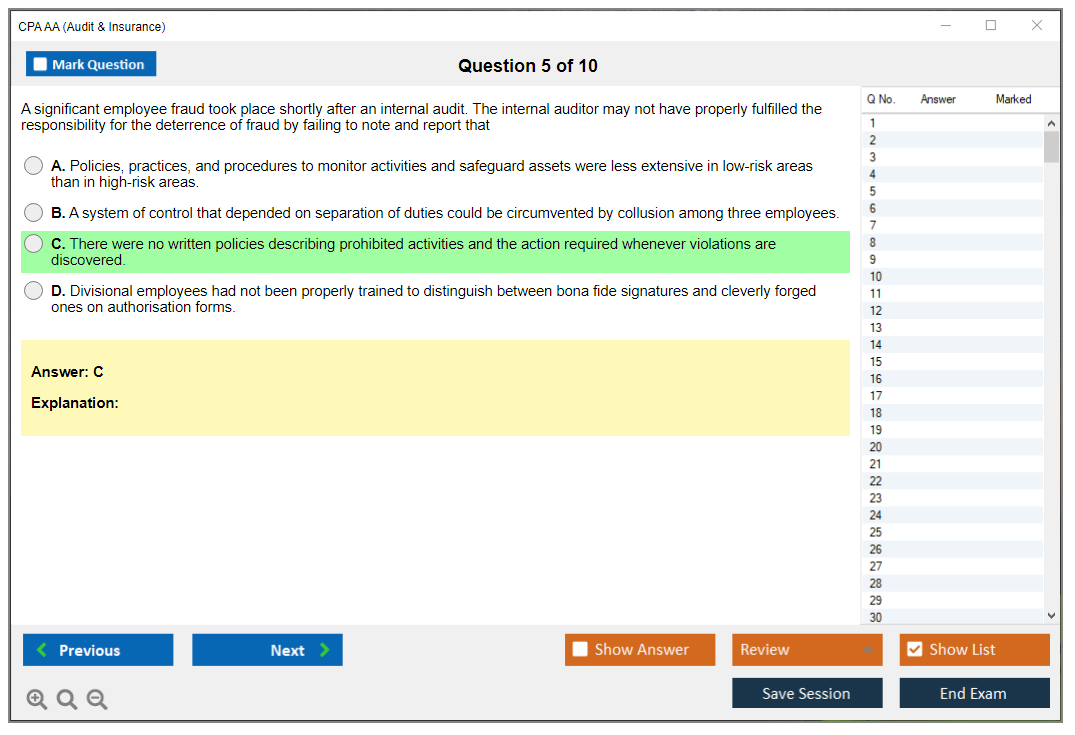

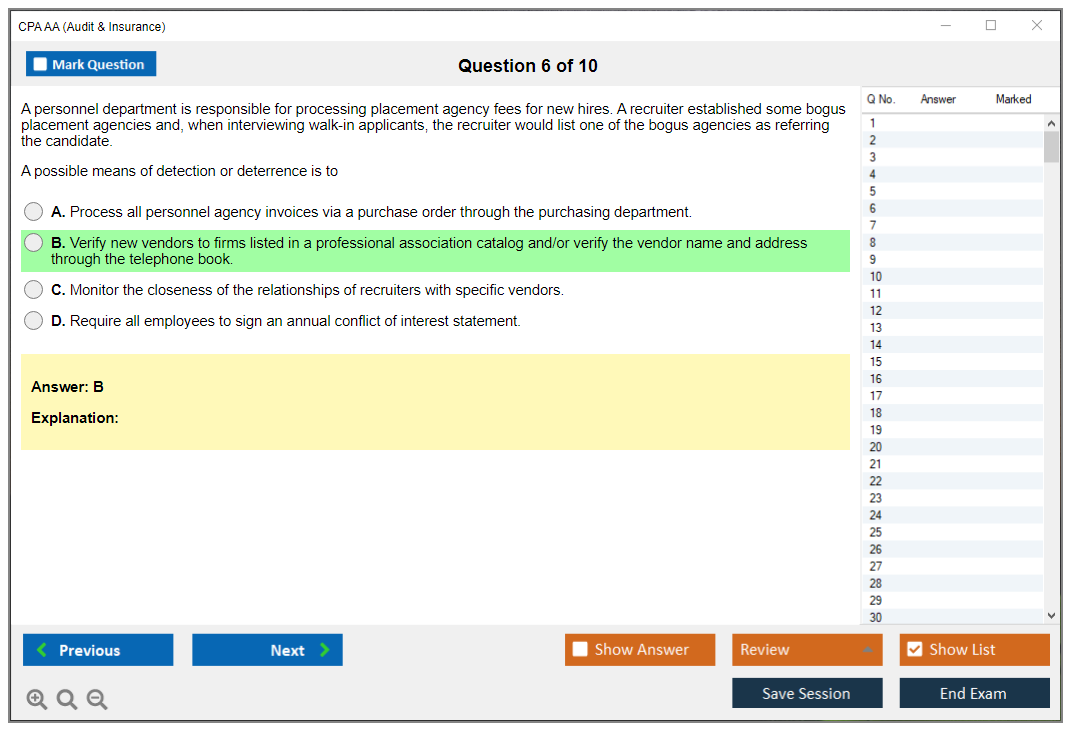

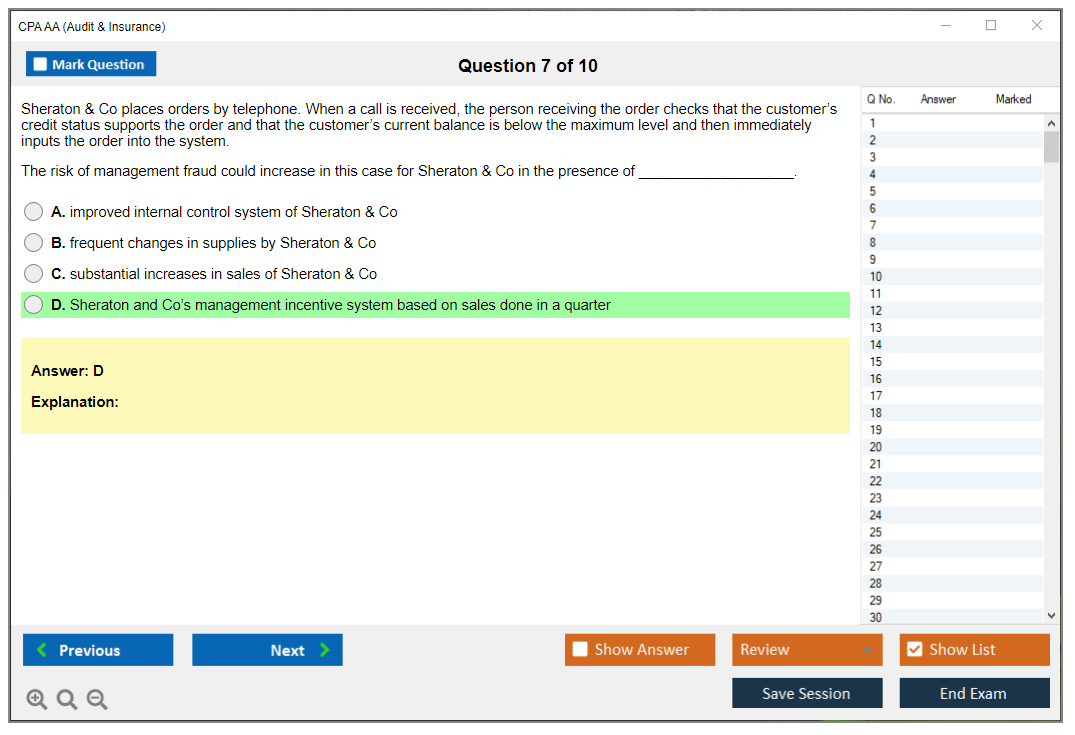

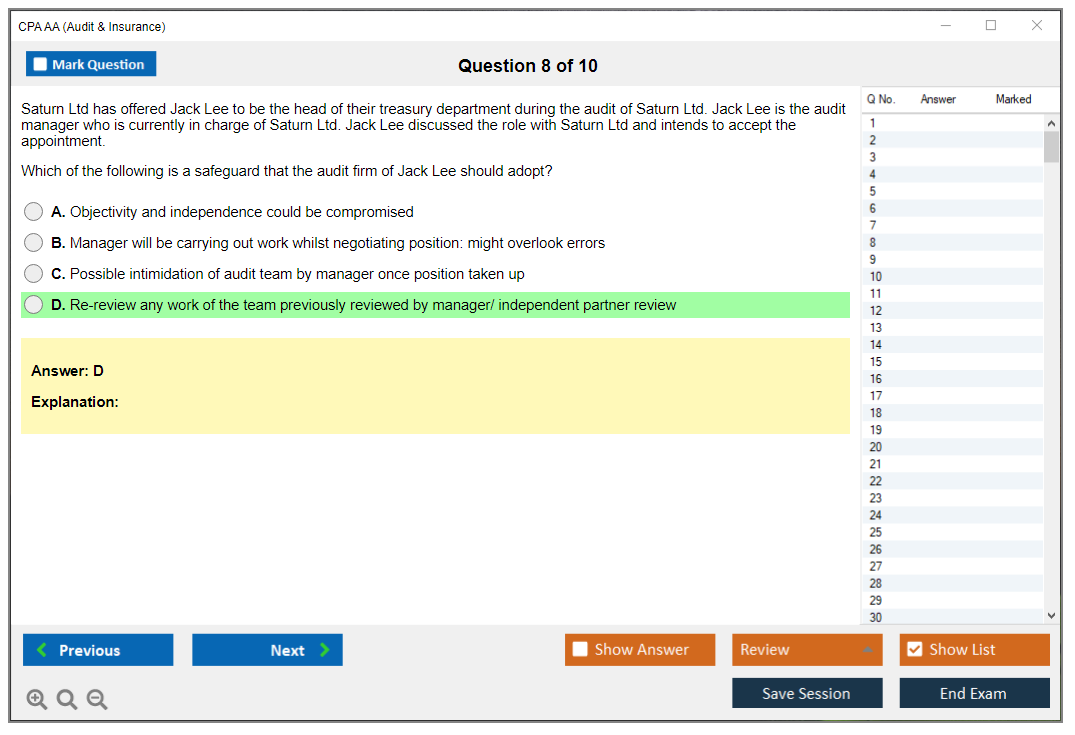

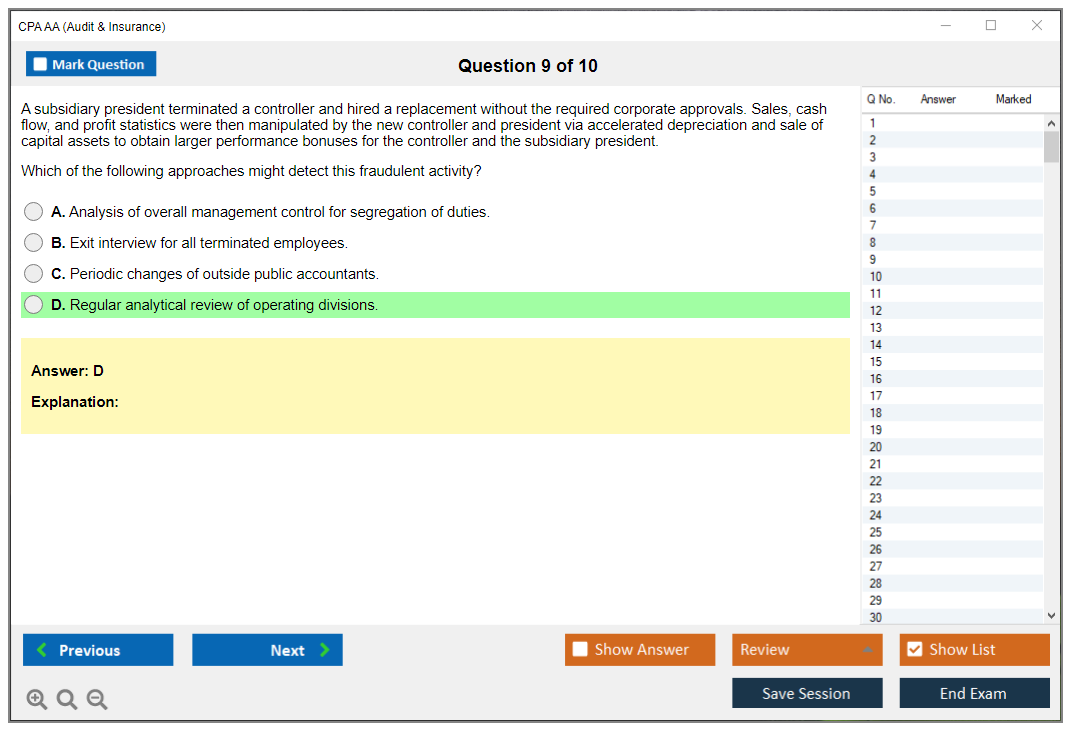

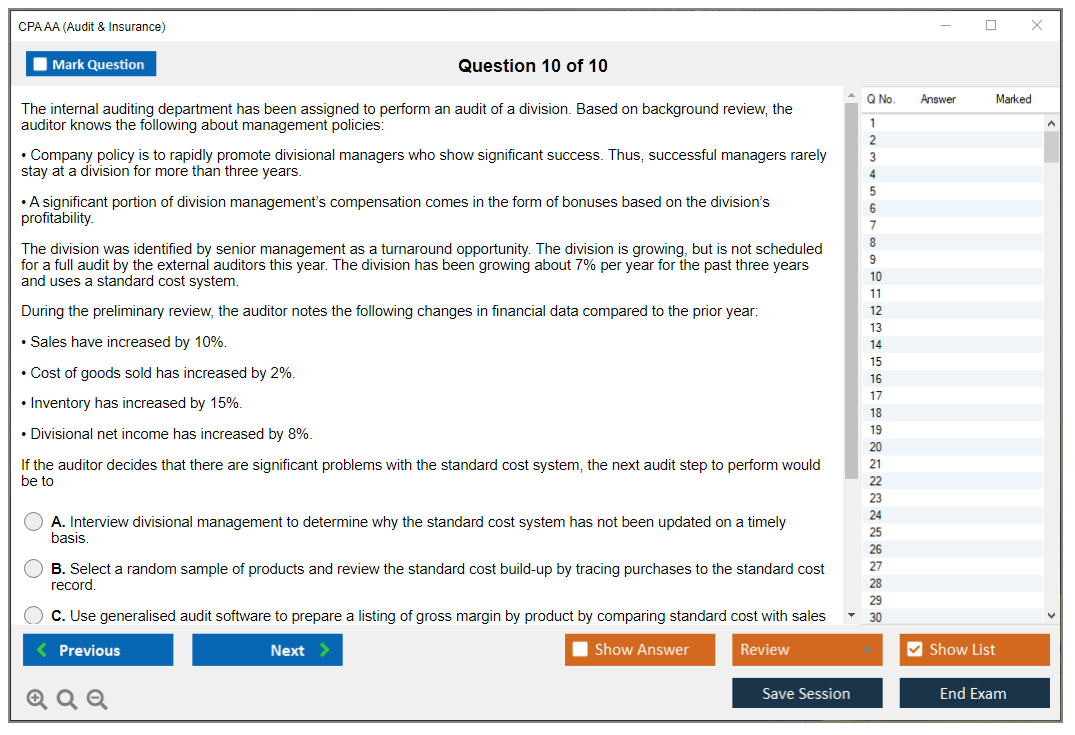

What are the Sample Questions of CPA AA Exam?

1. What is the purpose of the American Institute of Certified Public Accountants (AICPA) Auditing Standards?

2. What are the three components of an audit opinion?

3. What is the difference between an internal audit and an external audit?

4. What are the key steps in the audit process?

5. What is the purpose of a management letter?

6. What is the difference between a financial statement audit and a compliance audit?

7. What is the purpose of an audit risk assessment?

8. What is the difference between a single audit and a financial statement audit?

9. What is the purpose of the Generally Accepted Auditing Standards (GAAS)?

10. What is the purpose of the Sarbanes-Oxley Act?

Comments

Hot Exams

Related Exams

SAP Certified Associate - Developer - SAP Sales and Service Cloud

SAP Certified Associate - SAP S/4HANA Finance for Group Reporting Associates

Workspace ONE Design and Advanced Integration Specialist

ISTQB® Certified Tester Advanced Level - Test Manager [Syllabus 2012]

Certified Cost Consultant / Cost Engineer (AACE International)

PowerCenter Data Integration 9.x Administrator Specialist

Administration of Veritas eDiscovery Platform 8.0 for Administrators

Pre-Professional Skills Test (PPST) - Writing Section

Oracle SOA Suite 12c Essentials

Chartered Wealth Manager (CWM) Certification Level II Examination

Automation and DevOps Associate (JNCIA-DevOps)

Security, Expert (JNCIE-SEC)

Management Accounting

Finance

Audit & Insurance

Financial Reporting

How to Open Test Engine .dumpsarena Files

Use FREE DumpsArena Test Engine player to open .dumpsarena files

DumpsArena.com has a remarkable success record. We're confident of our products and provide a no hassle refund policy.

Your purchase with DumpsArena.com is safe and fast.

The DumpsArena.com website is protected by 256-bit SSL from Cloudflare, the leader in online security.